B2B Fintech Marketing: How to Build a Winning Strategy in 2026

Key Takeaways

- The fintech customer journey is lengthy, non-linear, and multi-staged.

- Tailored content at each stage boosts engagement and conversions.

- Detailed buyer personas and ABM are critical for precise targeting.

- SEO using content clusters drives sustained organic growth.

- Optimize for GEO (AI Overviews, ChatGPT, Perplexity) to win shortlists you never see.

- Data-driven personalization increases conversion rates and cross-selling.

- Multi-channel strategies help you to expand reach.

- Overcoming regulatory challenges requires transparent messaging.

Fintech’s potential for high-quality leads and revenue growth is massive. But navigating the complexities of B2B fintech marketing? It’s not always straightforward.

You might feel like you’re firing off marketing tactics in every direction, hoping something sticks. You’re publishing content, but it’s not ranking well in search engines, getting you the traffic or conversions you need, or it doesn’t seem to resonate with your audience.

If that’s you, don’t worry. In this guide, we’ll break down the essentials to creating B2B marketing strategies that deliver great results for fintech companies like yours. Let’s get started.

What is Fintech Marketing?

The Fintech Customer Journey

Key Strategies for Fintech Marketing

Creative Customer Acquisition Techniques

Fintech marketing requires campaigns that capture attention and leave lasting impressions.

Why opt for unconventional fintech marketing campaigns? They build trust by making your fintech brand more relatable and memorable. When you’re asking businesses to handle their financial operations, being memorable matters.

Examples of unconventional campaigns include:

- Experiential marketing: Create immersive experiences at industry events, like trade shows or conferences, that allow potential clients to interact directly with your product. For example, set up interactive booths where attendees can engage with a virtual demo or participate in a hands-on workshop that showcases how your fintech solution addresses common industry pain points. This approach captures attention and provides a memorable, practical experience that highlights the value of your offering.

- Guerrilla marketing: Use low-budget, high-impact tactics in unexpected places where B2B decision-makers are likely to be. For example, place branded digital screens or thought-provoking installations in financial district lobbies or business parks. These can share quick, powerful messages or stats that challenge conventional industry practices and pique curiosity, encouraging professionals to learn more about your solution.

- Viral marketing: Develop compelling content tailored for B2B audiences that has the potential to be widely shared within professional networks. This could include provocative thought leadership pieces, humorous takes on industry trends, or case study videos that highlight successful client partnerships. Ensure the content is optimized for platforms like LinkedIn, where it can easily gain traction among industry professionals.

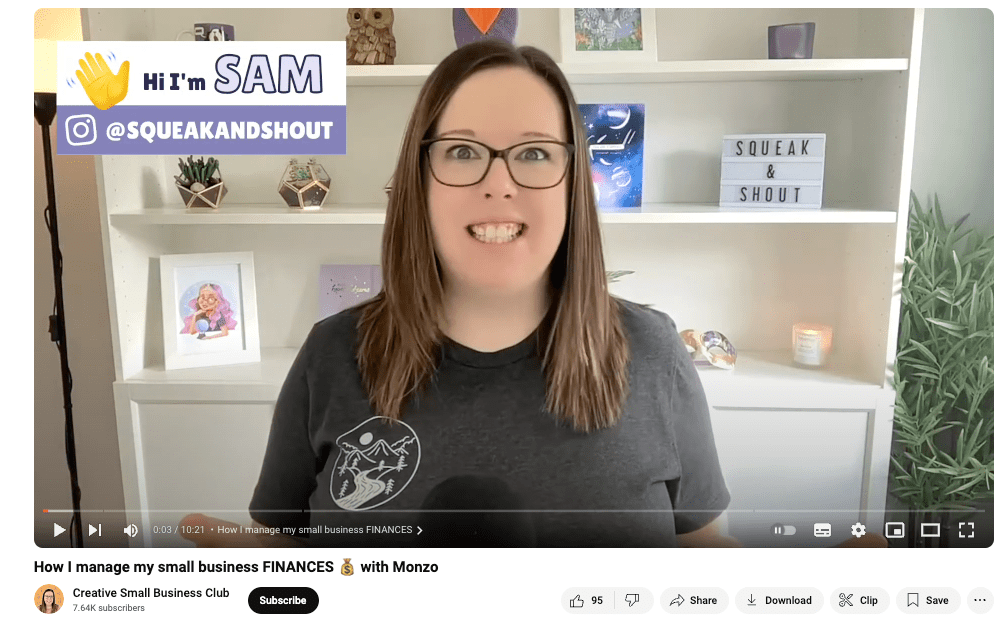

- Influencer collaborations: Partner with niche industry influencers or respected thought leaders who have credibility among your target audience. Collaborate on content like webinars, podcasts, or LinkedIn Live sessions where these influencers share insights about current challenges and how your fintech solution can help address them. This strategy not only amplifies your reach but also builds trust and authority within your specific market.

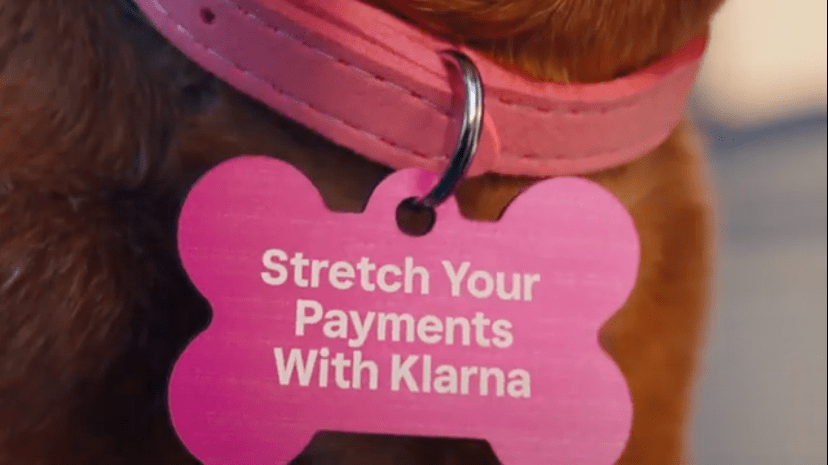

A standout example of creative marketing is Klarna’s collaboration with Paris Hilton. The payments company partnered with the Y2K icon to create the “House of Y2K” pop-up in Los Angeles—a nostalgic nod to the early 2000s.

This strategic move generated significant buzz and cemented Klarna’s modern fintech identity.

The global multimedia campaign also included a series of films featuring Hilton reacting to different Klarna product offerings with the catchphrase, “That’s Smoooth.”

Through this creative approach, Klarna promoted its stretched payment options in a memorable way.

While this is a B2C example, B2B fintech companies can take inspiration from this level of creativity. Imagine hosting an immersive pop-up at a major industry conference that showcases the future of finance through interactive technology demonstrations or virtual reality experiences.

Partnering with well-known industry thought leaders or tech innovators to co-create content—like live debates or trend showcases—could generate the same kind of buzz and engagement as Klarna’s campaign. The key takeaway is that B2B doesn’t have to be boring—being bold and unexpected can help differentiate your brand in a crowded market.

Content Marketing That Converts

Your fintech content marketing strategy needs to address the real challenges your potential clients face daily. High-quality content plays a critical role in educating your audience, building trust, and driving decision-making through every stage of the customer journey.

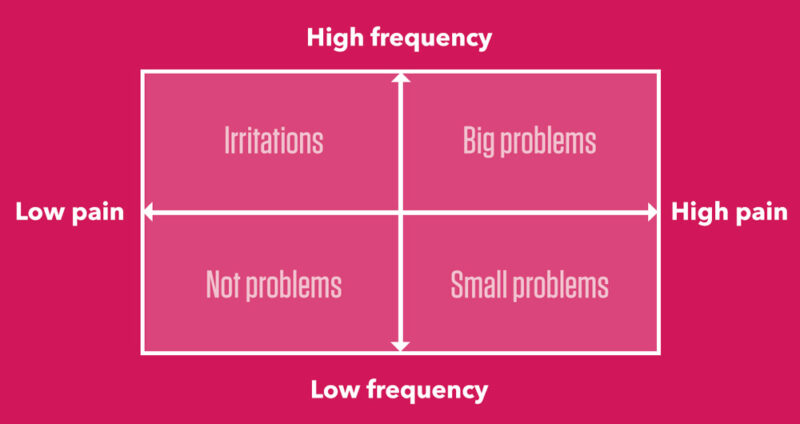

Begin by identifying the most pressing challenges your potential clients face in their daily operations.

Talk to your sales and customer success teams—they’re on the front lines, hearing firsthand about the issues plaguing potential clients. You might discover that regulatory compliance complexities, integration challenges with legacy systems, or data security concerns are at the top of your audience’s mind.

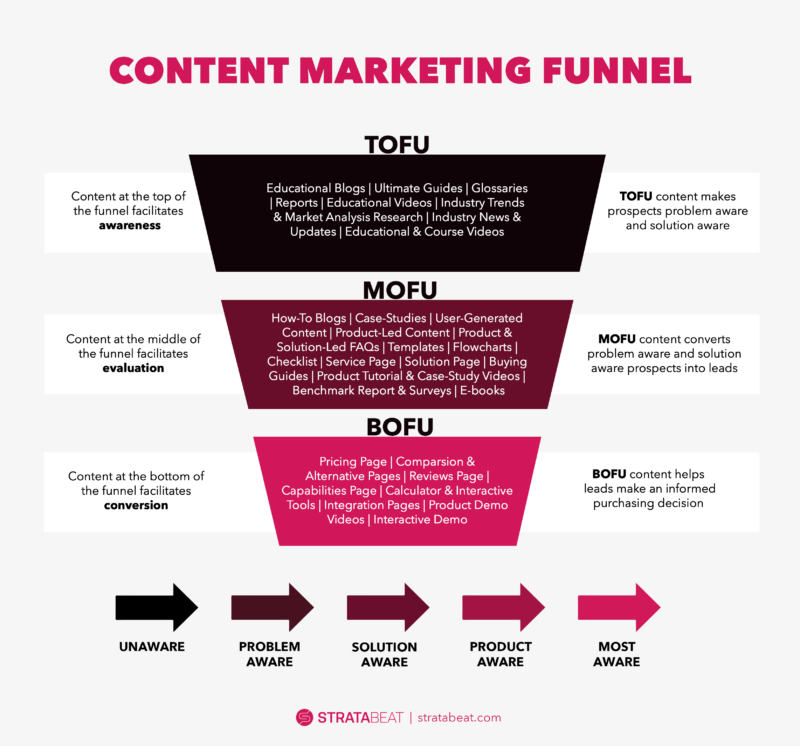

Once you understand these pain points, you can map each piece of content to the buyer’s journey or B2B marketing funnel. For those just becoming aware of their problems, blog posts explaining trends, comparison guides highlighting differences, and case studies with filters for specific goals all work to address your audience’s financial needs.

As they consider different financial institutions and financial solutions, offer comparison guides and case studies. For case studies, create filters for different goals so ideal customers can read stories from others who faced the same problems.

But what types of content work best? Plaid’s annual “Fintech Effect Report” provides valuable insights into consumer financial behavior, positioning Plaid as a trusted industry authority due to its thought leadership content. It’s also a useful lead magnet.

Hosting webinars demonstrating real-time financial analytics or creating video tutorials on navigating complex investment platforms also works well.

Plus, podcasts offer easily digestible insights for busy executives on the go.

The lesson here? Focus on creating content that truly helps your audience solve problems or make decisions. When you consistently deliver value, measured by metrics like a 20% increase in content engagement or a 15% higher click-through rate on targeted emails, you build trust and establish your brand as an indispensable resource.

High-Quality Content Creation for Fintech

High-quality content creation is the backbone of any successful fintech content marketing strategy. It’s not just about creating more content—it’s about creating the right content for the right audience at the right time.

For fintech companies, this means producing educational, actionable, and authoritative content that speaks directly to the pain points and goals of your target audience.

Leveraging Data for Personalized Marketing

B2B fintech companies collect lots of information about their business customers. This includes things like:

- Company size and industry

- How they use financial services

- What kind of money problems they’re trying to solve

Analyzing this data helps fintech companies pinpoint each business’s specific needs. Then, they can reach out with ideas that feel tailor-made to increase customer retention and satisfaction.

This approach has some big pluses. Business clients feel understood, which builds trust. Happy clients are more likely to stick around and tell other fintech business contacts about the service.

Here are some ways to use data for personalized marketing:

- Identify patterns: AI helps fintech companies sift through mountains of data to spot patterns humans might miss. For example, it can predict which businesses will likely need a loan in the next six months based on their cash flow trends. This lets the fintech company reach out at just the right time with the perfect offer.

- Predict customer behavior: By analyzing past behavior, predictive analytics can forecast what a business might need next. If a company’s transactions with international partners are increasing, the fintech might proactively offer better foreign exchange services.

- Improve onboarding: Customized onboarding uses data to tailor the setup process for each new business client. A small startup might get a simplified dashboard, while a large corporation could see more complex features right off the bat. This customized approach helps businesses feel at home with the platform from day one.

- Score customer engagement: This is like a health check for client relationships. By tracking how often a business uses different features, how they interact with customer support, and other behaviors, these companies can spot when a client might be losing interest. They can then step in with tailored help or offers to keep the relationship strong.

- Increase cross-selling: By understanding how a business uses its platform, fintech companies can suggest additional service offerings that make sense. For instance, a fintech company might notice that a business is frequently late on payments and use this data to recommend an automated invoicing system, reducing late payments by 30%.

- Personalize content: This goes beyond just using the client’s name in emails. It’s about changing entire web pages, app interfaces, and marketing materials based on the business’s profile and behavior. A retail client might see case studies about inventory financing, while a tech startup sees content about managing investor funds.

Using Behavioral Analytics and Website Visitor Detection for Targeted Marketing

Optimal Channels for Fintech B2B Marketing

Referral Gamification

Additionally, referral gamification is an often overlooked but highly effective strategy for engaging Millennials and Gen Z. Fintech companies can implement referral programs within their platforms, offering rewards, badges, or points for referrals.

Gamified elements encourage user participation and build a sense of community and loyalty. Monzo, for instance, has successfully used referral programs, pairing them with vibrant, user-friendly branding to appeal to younger users.

In-App Marketing

In-app marketing is another powerful yet underutilized channel in B2B fintech. Once users are on your platform, personalized in-app messages can guide them through the onboarding process, introduce them to new features, or offer special promotions tailored to their needs. This can be especially effective in converting users who are already engaged and active on your platform.

For example, fintech companies can use in-app notifications to highlight new functionalities that align with a user’s activity patterns or send push notifications about special offers or product updates. This channel is particularly effective for cross-selling or upselling products to current users who might not yet be aware of all the functionalities available to them.

Event Marketing and Networking

Fintech companies also leverage traditional channels like events—conferences, webinars, and networking meetups—to connect with key stakeholders, share knowledge, and get noticed.

These events are great for forging strategic partnerships and driving customer acquisition. However, it’s crucial to maximize ROI from these opportunities.

To maximize ROI from event participation, define specific goals you want to achieve, such as the number of leads generated, partnerships formed, or brand awareness metrics.

Use a multi-channel B2B marketing strategy to promote your participation. This includes using social media, email marketing campaigns, and B2B content marketing to create buzz around the event and encourage attendance.

Implement a robust follow-up strategy post-event to nurture leads. This can include personalized emails, thank-you notes, or exclusive offers to attendees who visited your booth or attended your session.

For example, when Stratabeat CEO, Tom Shapiro speaks on webinars and at conferences, he often gives away free copies of his books, “Rethink Lead Generation” and “Rethink Your Marketing” to the people who attend.

After the event, assess your performance by tracking key metrics like the number of qualified leads generated, the percentage of those leads that convert into customers, and attendee satisfaction scores.

Repurpose talks into AI-readable summaries and post transcripts—these assets are frequently surfaced in generative answers.

By integrating digital, social, referral gamification, in-app marketing, and traditional event marketing into a cohesive strategy, fintech companies can effectively reach different demographics and convert more prospects into loyal customers.

Overcoming Challenges in Fintech Marketing

Emerging Trends and the Future of Fintech Marketing

Partner with an Agency that Understands Fintech Marketing

Frequently Asked Questions

Content marketing plays a critical role in the fintech sector by creating valuable content that educates, engages, and nurtures relationships with your target market.

As fintech solutions address complex financial topics, educational content becomes essential to break down difficult concepts for a broad audience.

By providing content that resonates with your target customers, fintech companies can drive customer acquisition and retention.

Additionally, content marketing is a powerful tool to build trust, demonstrate expertise, and establish thought leadership, especially in a competitive market where differentiation is key.

Whether it’s white papers, blog posts, or case studies, content marketing in fintech ensures your digital presence aligns with the needs of the financial services industry and the financial sector, leading to increased engagement, user satisfaction, and business growth.

To stay ahead in the competitive markets of fintech, your content must continuously evolve with industry trends. One way to achieve this is by leveraging data-driven insights to identify emerging fintech marketing tactics, such as digital marketing strategies that incorporate fintech SEO, social media platforms, and Google Ads.

By analyzing Google Analytics and closely monitoring fintech marketing trends, fintech companies can ensure their content addresses the financial consumers’ current pain points.

Moreover, creating content on innovative solutions and staying informed on regulatory updates will strengthen your online presence and SEO rankings.

Partnering with a fintech content marketing agency can provide a comprehensive approach to adapting your content to stay relevant, impactful, and engaging, ensuring long-term success in the fintech sector.

A successful fintech content strategy hinges on understanding both your target user base and the financial technology companies you’re competing against.

Start by identifying the key services and solutions that your business offers, then tailor your content marketing activities to address your audience’s most pressing needs.

The foundation of your strategy should be based on educational content that breaks down complex fintech solutions into easily digestible insights.

Incorporate email campaigns, social proof, and user-generated content to nurture leads throughout the buyer journey.

Regularly assess your content’s impact using Google Analytics, optimizing for search engine rankings by focusing on SEO and ensuring each piece of content aligns with your strategic approach.

Furthermore, maintaining a consistent editorial calendar helps keep your content on track and consistent, making it easier to address current financial situations and market shifts.

In fintech, customer loyalty is closely tied to how well you can keep providing relevant content that speaks directly to your customers’ evolving needs. Fintech companies can retain customers by consistently offering informative content that helps users understand new financial services industry innovations, financial literacy, or how to optimize their use of your product.

Content can also be personalized based on user acquisition patterns, providing tailored insights into complex topics like credit scoring or alternative credit methods. Maintaining engagement through regular, helpful content keeps customers informed and builds trust in your brand, reducing customer acquisition costs and fostering long-term relationships that drive business growth.

By leveraging digital platforms and community marketing, fintech firms can continue to deliver content that supports customer needs and enhances satisfaction.

SEO is vital in fintech content marketing because it directly impacts your search engine rankings and overall online presence. Fintech companies must optimize their content for both broad and niche keywords.

A strategic approach to SEO will not only increase your visibility on Google but also help drive organic traffic to your site, attracting highly qualified leads. When combined with search engine optimization techniques like content clustering and long-tail keywords, fintech companies can dominate niche markets and rank for highly specific search terms, enhancing their digital presence.

Regularly updating your content based on fintech marketing trends will ensure your website remains a trusted source in a highly competitive market.

Effective content for fintech marketing should provide educational content that aligns with the pain points and goals of your target customers. Top-performing content types in fintech include white papers, case studies, and comparison guides that showcase how your solutions address common industry challenges.

Additionally, consider integrating financial content into webinars or podcast series that explore trending topics in the fintech sector.

Visual content, such as infographics and user-generated content, can also simplify complex topics and make your brand more relatable.

Ensure that your content marketing strategy includes a comprehensive suite of materials that address different stages of the buyer’s journey—from awareness to purchase.

Partnering with a fintech content marketing agency provides deep industry knowledge and a comprehensive approach that can scale your marketing efforts effectively. A specialized agency can help create valuable content that resonates with your target customers, ensuring each piece of content aligns with your overall fintech content strategy.

An agency like Stratabeat can also optimize your content for SEO, ensuring it ranks well and attracts organic traffic.

By leveraging a fintech-focused agency’s fintech marketing tactics, you’ll be able to stay ahead of the competition while driving user acquisition and business growth.

Creating educational and relevant content is essential for building trust in the financial services industry. For fintech companies, content must not only inform but also simplify complex topics like alternative credit scoring, blockchain, or digital payments.

Providing actionable, insightful content that addresses real-world challenges can position your brand as a thought leader and a trusted advisor in the fintech sector.

Additionally, relevant content helps keep your audience engaged, increasing brand loyalty and fostering deeper customer relationships.

As fintech continues to evolve, delivering informative content that addresses the changing landscape of the financial technology space helps ensure your business remains competitive and visible to the right target market.

Content marketing is one of the most effective tools for lead generation in fintech. By creating high-quality, relevant content that addresses your audience’s specific financial challenges, you can attract leads at every stage of the funnel.

Use educational blogs, case studies, and white papers to build awareness, while webinars and email campaigns can help move prospects through the consideration stage.

Digital advertising platforms like Google Ads or LinkedIn allow you to target specific decision-makers in the financial services industry, while affiliate marketing and micro-influencers can extend your reach.

By providing content that speaks to their needs, fintech companies can convert leads into long-term clients.

Measuring the success of your fintech content marketing requires tracking key performance indicators (KPIs) like traffic (via Google Analytics), engagement rates (clicks, shares, comments), and conversion metrics. By assessing data-driven insights, fintech companies can understand which content pieces are driving the most value and adjust their strategy accordingly.

Consider metrics like customer acquisition costs, sales team feedback, and lead quality to refine your content strategy.

Additionally, tracking SEO performance and search engine rankings will provide a clear picture of how your content is performing in search engines and its ability to attract qualified traffic.