The Future of Fintech SEO: AI & Organic Strategies to Dominate the SERP

Key Takeaways

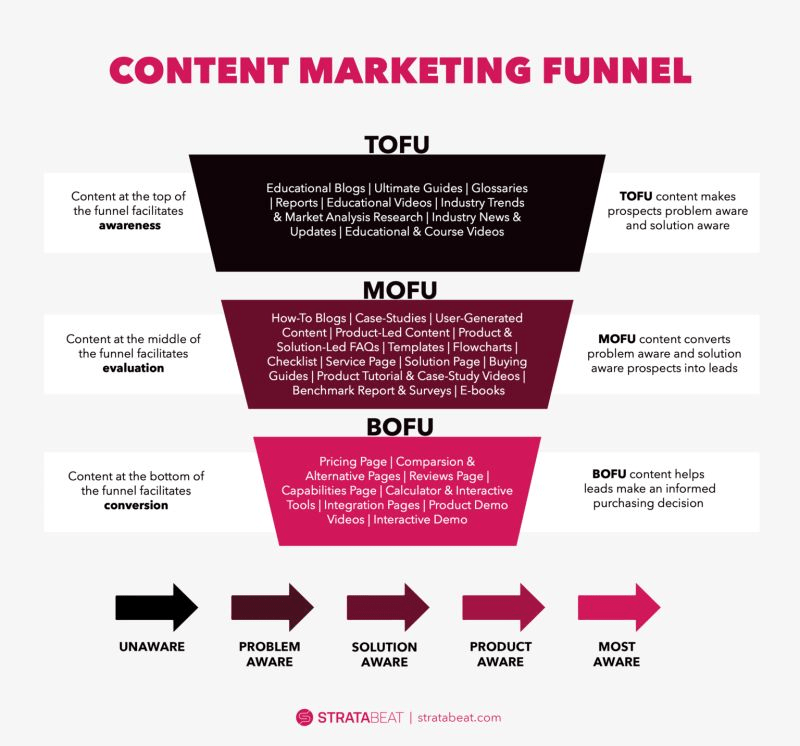

- AI-Driven Research: Fintech buyers increasingly rely on AI-driven search, so brands must optimize for both AI Overviews and organic search to capture high-intent traffic.

- SEO Remains Vital: Despite AI innovations, authoritative, research-backed SEO is essential for attracting and converting high-intent fintech buyers.

- Dual Optimization Approach: Combining traditional SEO with AI-optimized strategies (such as structured data and expert content) ensures visibility in both organic and AI-generated results.

- Credibility is Crucial: Fintech decision-makers demand expert insights, proprietary research, and real-world case studies to build trust and drive engagement.

- Full-Funnel Strategy: A comprehensive approach—from top-of-funnel educational content to conversion-focused CTAs—ensures sustainable lead generation and revenue growth.

- Cost Efficiency: Investing in SEO reduces customer acquisition costs over time compared to expensive, short-lived paid search campaigns.

- Linking Power: Strategic internal and external linking helps Google’s crawlers understand your site’s structure and content relevance, boosting overall authority.

- Technical Excellence: Regular technical SEO audits (pre-launch, post-launch, and ongoing) are critical for maintaining site performance and competitive search authority.

- Adapt and Evolve: Continuously monitoring AI trends, SERP changes, and user behavior allows you to refine your SEO strategy and maintain a competitive edge.

- SEO vs. Paid Search: Organic SEO outperforms paid search in cost efficiency and long-term growth, delivering compounded benefits and higher ROI.

- Conversion-Driven Funnel: A full-funnel SEO strategy ensures that increased traffic is effectively converted into leads, demos, and revenue.

- Trust Drives Conversions: Publishing original research, industry-specific insights, and SME-backed content builds authority and trust, improving rankings in both AI and organic search.

The Future of Fintech SEO Isn’t What You Think

Why Should B2B Fintech Companies Invest in SEO?

Winning High-Intent Fintech Buyers in an AI-Driven Search Landscape

B2B Fintech SEO Strategies that Work

How to Measure the ROI of SEO (Full Guide with KPIs & Calculator)

Check out Stratabeat’s SEO ROI Calculator to estimate your potential ROI from organic search. Read the PostTech SEO Audits

Technical SEO determines search visibility. Regular audits identify and resolve issues that impact rankings. Too many fintech companies don’t take technical SEO into account at the right moments; it’s either overlooked while building a new website, or it’s not taken into consideration after launching new website updates. Here’s what we recommend:

Before Launch

Before you go live, run a comprehensive technical SEO audit on your staging site. Verify that your site architecture, URL structures, and internal linking are optimized. Ensure that critical elements like meta tags, canonical tags, schema markup, and XML sitemaps are correctly implemented. Test page speed, mobile responsiveness, and SSL security to prevent any issues at launch. Use crawl simulation tools to spot potential crawl or indexation issues before the public sees your site.

After Launch

Right after launch, conduct a post-deployment SEO audit to catch any issues that may have slipped through. Check for crawl errors, broken links, and redirect issues. Confirm that your analytics and tracking codes are firing correctly, and re-submit your updated sitemap to search engines. Monitor key metrics like page speed and mobile usability, and address any discrepancies between your pre-launch benchmarks and live performance immediately.

Ongoing Monitoring

For sustained SEO health, schedule regular technical audits. Depending on the size of your website, a quarterly deep-dive audit is ideal for uncovering less obvious issues, while monthly checks help you catch critical errors like 404s, security vulnerabilities, and changes in core web vitals. Maintain a proactive approach by staying informed about search engine algorithm updates and continuously optimizing your site based on the latest best practices.

A proactive approach to technical SEO protects long-term organic performance and maintains search authority in a competitive fintech landscape.

Optimization Strategies for Fintech

Making Structured Data & Technical SEO More Human-Friendly

Many fintech companies struggle with technical SEO because it feels complex and abstract. But in reality, it’s just about making it easier for search engines to understand your site.

How Search Engines Interpret Content: A Fintech Example

Say you’re optimizing a page for “automated fraud detection software for fintech.” Instead of stuffing that keyword everywhere, focus on placing it naturally in key areas:

- Title Tag: How Automated Fraud Detection Software is Changing Fintech Security

- H1: Automated Fraud Detection for Fintech: How AI is Preventing Fraud

- URL Slug: /fintech-fraud-detection/

- H2s & H3s: What is Fintech Fraud Detection?, Best Practices for Preventing Fraud in Financial Services

- First 100 Words: Fraud detection is a top priority for fintech companies. With increasing regulatory pressure and rising financial crimes, automated fraud detection software is helping businesses stay compliant and prevent fraudulent transactions in real time.

| Where to Place the Keyword | Best Practice | Example |

|---|---|---|

| Title Tag | Include primary keywords naturally. | “How Automated Fraud Detection Software is Changing Fintech Security” |

| H1 | Clearly state the page focus using relevant keywords. | “Automated Fraud Detection for Fintech: How AI is Preventing Fraud” |

| URL Slug | Use concise, keyword-rich URLs. | /fintech-fraud-detection/ |

| Headings (H2/H3) | Organize content with subheadings addressing key questions. | “What is Fintech Fraud Detection?” “Best Practices for Preventing Fraud in Financial Services” |

| First 100 Words | Introduce the financial topic with key details early on. | “Fraud detection is a top priority for fintech companies. With increasing regulatory pressure and rising financial crimes, automated fraud detection software is helping businesses stay compliant and prevent fraudulent transactions in real time.” |

Keywords: What To Do With Them

- Keyword strategy must prioritize depth, relevance, and natural integration to align with user intent.

- Identify a primary keyword aligned with search intent.

- Select related keywords to support semantic relevance.

- Integrate the primary keyword into the page title, H1, and URL slug.

- Use H2-H4 headings to structure content around high-value search queries.

- Introduce key terms within the first 100-200 words to establish context early.

- Distribute keywords organically throughout the page to maintain readability and engagement.

Optimizing a page for “fintech risk management software”

- Title Tag: Fintech Risk Management Software: Reduce Compliance Risks with AI-Powered Solutions

- H1: How Fintech Risk Management Software Helps Companies Stay Compliant

- URL Slug: /fintech-risk-management-software/

- H2s & H3s: What is Fintech Risk Management?, How AI Enhances Risk Detection

- First 100 Words: Fintech companies face increasing regulatory pressure. The right fintech risk management software can streamline compliance and prevent fraud while reducing operational risks.

- Meta Description: Discover how AI-driven fintech risk management software helps you mitigate risks. Try a free demo today!

Meta Descriptions: Do They Matter?

Meta descriptions do not directly impact rankings but significantly influence click-through rates (CTR).

A compelling meta description should:

- Include the primary keyword naturally.

- Provide a concise summary of the page’s value.

- Use action-driven language to encourage clicks.

Example Meta Description:

“Discover fintech SEO strategies that drive growth. Learn how AI-driven search, structured data, and optimized content boost visibility and conversions.”

Make sure your meta descriptions and title tags are the proper length so they don’t end up getting truncated in the SERP. You can use tools like an Excel doc or meta description length checker online.

How Structured Data Helps Fintech Companies Rank Higher

Fintech buyers need quick access to key details like pricing, security features, and compliance certifications. Structured data helps Google highlight this information directly in search results.

Example Schema Markup for a Fintech Product Page:

{

“@context”: “https://schema.org”,

“@type”: “SoftwareApplication”,

“name”: “Automated Fraud Detection Software”,

“description”: “AI-powered fraud detection software for fintech companies, providing real-time transaction monitoring and compliance automation.”,

“operatingSystem”: “Web-based”,

“applicationCategory”: “FinancialApplication”,

“offers”: {

“@type”: “Offer”,

“priceCurrency”: “USD”,

“price”: “149.00”,

“availability”: “https://schema.org/InStock”,

“url”: “https://example.com/fintech-fraud-detection”

},

“aggregateRating”: {

“@type”: “AggregateRating”,

“ratingValue”: “4.9”,

“reviewCount”: “312”

}

}

Why This Matters:

- Helps Google display enhanced search results (like pricing and reviews).

- Improves click-through rates (CTR) because users get key info upfront.

- Boosts AI Overview citations, ensuring your fintech brand gets referenced.

PAA (People Also Ask)

Google’s PAA section surfaces high-intent user queries. Incorporating these questions into content strengthens topical relevance and featured snippet opportunities.

- Identify high-ranking PAA questions related to your fintech topic.

- Structure answers concisely in a Q&A format.

- Use subheadings (H2-H4) to align with common PAA queries.

- Leverage tools like Thruuu to analyze top-ranking PAA results.

Linking: Strengthening SEO & UX

Internal and external links not only boost SEO performance and user engagement but also help Google’s crawlers understand your site’s structure and content relevance.

These links serve as pathways for bots to index your pages, clarify your site’s hierarchy, and signal the topical focus of your content.

Internal Linking

- Link to 2-3 related pages within the same content hub.

- Use descriptive anchor text aligned with target keywords to inform both users and crawlers about the page context.

- Connect users to key conversion pages (pricing, case studies, demos).

This clear internal linking structure enables Google’s crawlers to efficiently navigate your site and distribute page authority, ultimately reinforcing your site’s subject matter.

According to our research, websites that implement internal linking in blogs see a 2.3X increase in organic traffic and 36.8% referring domain growth, proving the impact of a strong content hub strategy.

External Linking

- Reference authoritative, high-DR sources to reinforce credibility.

- Cite original research, case studies, and financial reports to provide context and add value.

- Avoid linking to direct competitors while including relevant industry resources.

These external links help Google’s crawlers assess the quality and relevance of your content by connecting your site with trusted, related information across the web.

AI Engine Optimization

AI engines prioritize well-structured, informative content. Content optimized with clear structure and authoritative data improves visibility in AI-generated results.

Snackable Content

AI engines favor content that is structured for easy parsing and user-friendly consumption.

Formatting Techniques:

- Short paragraphs (2-3 sentences) for better readability

- Bullet points & numbered lists for clear takeaways

- Direct answers to common fintech queries

- Tables, expandable sections, and charts to organize data

- Bold highlights to emphasize key phrases

Content Structuring Best Practices:

- Key Takeaways: Summarize each blog with 3-4 crucial insights.

- FAQs: Use a Q&A format for better AI parsing.

- TOCs: Add a table of contents with jump links for quick navigation.

- Definitions: Structure “What is” and “How to” queries in dedicated definition blocks.

Monitoring & Adapting to AI Search Changes

AI-generated results evolve continuously. Regularly reviewing how AI tools summarize content helps refine SEO strategies.

- Track how AI Overviews present answers.

- Adjust key sections for better clarity and citation potential.

- Update content regularly to reflect shifts in AI interpretation.

Optimized structured data and E-E-A-T (Experience, Expertise, Authoritativeness, and Trustworthiness) signals strengthen a fintech website’s presence in AI-driven search environments.

The SEO and GEO Overlap

SEO success depends on credibility. Content aligned with Google E-E-A-T performs better across all search engines, including AI-driven tools.

Key SEO & E-E-A-T Optimization Tactics:

- Data-backed content: Incorporate relevant stats, SME quotes, case studies, and real-world use cases.

- Trust-building content: Feature customer testimonials and proprietary product insights.

- On-page optimization: Include image alt text with relevant keywords where applicable.

SEO does more than drive traffic; it establishes fintech brands as credible, trustworthy sources. In a highly regulated industry, buyers rely on brands that provide authoritative, research-backed content.

And Stratabeat’s data proves it:

- Websites with original research see 3.2X more organic traffic and 42.2% more referring domains.

- Well-researched long-form content (2,000+ words) drives 10.2X more organic traffic growth than shorter posts.

- Expert-backed content featuring SME insights improves engagement and credibility.

Tom Shapiro, CEO of Stratabeat, explains:

“You can’t optimize mediocrity. Brands that invest in depth, expertise, and high-value content will dominate both AI-driven and traditional search.”

Audio-Visual Elements

Multimedia assets increase engagement and accessibility, improving AI-driven discoverability.

Best Practices for SEO-Optimized Media:

- Use alt attributes with descriptive text for images, graphs, and visuals.

- Embed relevant videos, AI-generated audio summaries, and interactive media.

- Leverage AI-powered tools like Trinity Audio, Eleven Labs, or WellSaid for audio versions of blog content.

- Provide video transcripts to enhance search indexing.

- Include closed-captioning for self-hosted videos.

Fintech websites leveraging audio-visual content improve search visibility, engagement, and AI parsing capabilities.

You can’t optimize mediocrity. Brands that invest in depth, expertise, and high-value content will dominate both AI-driven and traditional search.