Top B2B Fintech Content Marketing Strategies for Business Growth

Key Takeaways

- Build Trust with Expert Guidance: Position your financial services brand as a reliable fintech industry leader by offering clear, expert insights that simplify complex financial topics.

- Adopt a Data-Driven Strategy: Leverage data-backed content to shorten sales cycles and drive competitive differentiation.

- Align with Informed Buyer Journeys: Cater to research-oriented fintech buyers by creating fact-based, informative content that addresses regulatory, risk, and technical concerns.

- Embrace Diverse, Valuable Content Formats: Utilize a mix of blogs, whitepapers, case studies, videos, and interactive tools to engage audiences at every stage of the buyer journey.

- Optimize for SEO and Local Markets: Focus on high-intent, geo-specific keywords and content to increase customer engagement and meet buyers at the exact moment they need solutions.

- Integrate Compliance Early: Ensure content is developed with built-in legal and regulatory checks to build credibility and mitigate risks.

- Differentiate Through Competitive Analysis: Perform content audits and identify content gaps and underserved audience segments to distinguish your brand from competitors in the financial industry.

- Maximize Distribution & Amplification: Deploy both organic and paid distribution strategies to extend your reach, boost ROI, and achieve business growth.

- Demonstrate Clear ROI: Track key performance indicators—like organic traffic, pipeline growth, and other business goals—to validate the impact of your content initiatives.

- Leverage Emerging Trends & AI: Stay ahead by incorporating market trends such as video-first content, thought leadership on LinkedIn, and AI-driven tools for research and personalized content while maintaining a human touch.

The finance industry moves fast. To build trust, fintech brands need to provide expert guidance and simplify complex financial topics.

A data-backed content strategy positions fintech companies as leaders in the financial sector, shortens the sales cycle, and differentiates them in a crowded market.

This guide breaks down essential elements of a winning fintech content marketing strategy—including industry best practices, proven frameworks, and real-world examples from fintech leaders.

Why B2B Fintechs Need Content Marketing

B2B fintech buyers conduct extensive research, assess risk, and seek deep expertise before making decisions. Effective content marketing efforts ensure fintech brands reach their ideal customers, provide relevant content that answers pressing financial concerns, and streamline the decision-making process. In a competitive market, creating informative, accessible content helps financial services companies acquire loyal customers and build long-term relationships.

What is Content Marketing in Financial Services?

Content marketing in financial services builds credibility by offering relevant content that directly addresses customer pain points. Unlike ads, which focus on promotion, content marketing educates, nurtures, and fosters trust among prospective customers evaluating financial solutions.

To attract and retain a wide range of ideal customers, B2B fintech brands must develop whitepapers, blogs, case studies, and interactive tools that simplify financial challenges, regulatory changes, and industry shifts. Strong content marketing efforts enhance brand credibility, support customer acquisition, and help businesses differentiate themselves in a competitive market.

Why is Content Marketing Important in Finance?

Every financial decision hinges on confidence. Businesses won’t commit to fintech solutions unless they trust their security, stability, and compliance. Prospective customers expect clear, data-driven content that reassures them at every stage of their journey.

Key challenges fintech content must address:

- Regulatory Complexity: Compliance requirements make content approval cycles longer. Content marketers must collaborate with legal teams to ensure accuracy while maintaining clarity.

- Long Sales Cycles: Multiple stakeholders (CFOs, IT, compliance) require tailored content that meets the unique concerns of a target market evaluating solutions.

- Technical Accessibility: Financial concepts can be complex—content marketing efforts should break down technical jargon into relevant content that speaks directly to prospective customers.

- Trust & Differentiation: Security, compliance, and real-world success stories establish fintech credibility and set brands apart in a competitive market.

A well-executed content plan provides clarity, reduces friction, and accelerates the buying process, helping fintech companies acquire loyal customers while strengthening their industry presence.

Why Educational Financial Content Matters—Even for B2B

When financial planning, B2B fintech buyers demand accuracy, clarity, and relevance. Unlike B2C audiences, where financial decisions are made by a small unit (like families), B2B decision-makers need buy-in from several teams, and they rely on fact-based insights to navigate complex topics and make informed financial choices for the whole organization.

Strong content marketing efforts help fintech brands grow their customer base, improve search engine rankings, and provide compelling content that addresses critical financial concerns.

Anticipate Key Financial Questions

Buyers seek solutions for regulatory shifts, risk management, and cost efficiency. One off the key benefits of content marketing is addressing these concerns with compelling content attracts engaged traffic, reinforces financial expertise, and strengthens digital marketing efforts.

Educational blogs, whitepapers, and financial services industry reports provide the necessary depth to support decision-making and ensure fintech brands remain top of mind for potential clients.

Simplify Complex Financial Information

Financial content often contains intricate details and compliance-heavy language, which can alienate potential buyers. A well-structured content approach breaks down complex topics into clear, digestible insights.

By eliminating unnecessary jargon and delivering relevant content, fintech brands can increase audience engagement, enhance search engine rankings, and expand their customer base with more accessible educational resources.

Create Interactive Financial Content

Interactive tools like ROI (return on investment) calculators, loan comparison models, and compliance checklists provide prospective buyers with hands-on ways to evaluate financial decisions.

This type of compelling content improves engagement, keeps visitors on-site longer, and strengthens their confidence in fintech solutions. Incorporating interactive elements into digital marketing efforts not only enhances customer experience but also improves search engine rankings by encouraging longer session times and increased interaction.

6 Elements of a Winning B2B Fintech Content Strategy

Your content marketing activities in fintech must be intentional. Every piece should serve a clear objective—demand generation, organic visibility, lead nurturing, or sales enablement.

1. Audience Insights: Aligning Content with Buyer Needs

Understanding the audience is foundational. CFOs, compliance officers, and product teams each have distinct concerns that content must address. A data-driven approach helps fintech brands tailor compelling content that resonates with their customer base and improves search engine rankings.

SEO & GEO: Meet Buyers Where They Are

To reach decision-makers at the right moment, fintech brands must integrate SEO into their digital marketing efforts:

- Learn what your ICP is searching for and figure out how to show up in search results at the exact moment they need solutions.

- Use Ahrefs and SEMrush to identify fintech-related keywords that trigger AI Overviews (AIO) and optimize content accordingly.

- Create geo-specific content for markets with different financial regulations and banking structures to maximize local visibility.

2. Competitive Intelligence: Find the White Space

Studying competitors provides insights, but copying them won’t work. The strongest fintech brands uncover content gaps, serve underserved audiences, and develop compelling content that distinguishes them in a competitive market.

Tactics for standing out:

- Analyze existing content and engagement metrics

- Spot content gaps that competitors overlook

- Leverage alternative formats like interactive tools, proprietary reports, or deep-dive case studies

3. Compliance-First Content Strategy

Compliance should be integrated into the content creation process, not treated as an afterthought. Fintech brands must align with SEC, FINRA, GDPR, and other regulatory requirements to mitigate risk and improve credibility with their customer base.

Best practices for legally sound content:

- Simplify legal language: Break down regulations into digestible insights.

- Prioritize transparency: Explain risks and benefits in straightforward terms.

- Embed compliance reviews early: Prevent last-minute rewrites by integrating legal checks into workflows.

4. Define How You’re Going to Win

A fintech brand without a clear differentiation strategy risks getting lost in the noise.

Steps to establish a strong content position:

- Document your end goals and process goals to ensure alignment across marketing, sales, and leadership teams.

- Establish your differentiation pillars—whether it’s original research, regulatory expertise, or interactive content.

- Define your brand as an educator, problem solver, and category leader.

5. Distribution & Amplification: Content ROI Comes from Visibility

Publishing is the starting point, not the finish line. A strong distribution strategy ensures content reaches your target audience.

Tactics for content promotion and amplification:

- Leverage content atomization: Turn one high-value report into blogs, videos, LinkedIn posts, and downloadable assets. Look for atomization opportunities to maximize impact and increase content marketing ROI.

- Use paid amplification: Target fintech executives with LinkedIn Ads, Google Ads, and native advertising.

- Equip sales teams: Sales and SDRs should have access to content that directly addresses objections, nurtures leads, and closes deals.

6. Editorial Calendar & Integrated Marketing Strategy

A structured content plan keeps marketing teams and the larger financial services organization aligned and ensures consistent execution.

- Map content to each stage of the buyer journey: Awareness, consideration, and decision-stage assets should be planned in advance.

- Maintain a steady publishing cadence: Consistency matters more than sheer volume.

- Plan content around integrated themes: Cohesive campaigns perform better than one-off content pieces.

| Element | Key Focus | Tactics/Examples |

|---|---|---|

| 1. Audience Insights | Align content with buyer needs | Data-driven research; SEO & geo-targeting to meet decision-makers at the right moment. |

| 2. Competitive Intelligence | Identify content gaps and white space | Analyze competitors; leverage alternative formats (e.g., interactive tools, case studies). |

| 3. Compliance-First Content Strategy | Integrate compliance into content creation | Simplify legal language; incorporate early compliance reviews. |

| 4. Define How You’re Going to Win | Differentiate your brand | Establish unique differentiation pillars (original research, regulatory expertise). |

| 5. Distribution & Amplification | Ensure content reaches the target audience | Use content atomization, paid amplification, and equip sales teams with tailored assets. |

| 6. Content Calendar & Integrated Strategy | Maintain consistent, aligned content planning | Map content to buyer journey stages; adhere to a steady publishing cadence. |

Best Practices for Fintech Content Marketing

Successful fintech content marketing requires data-driven execution, compliance awareness, and ongoing refinement. Content should attract potential buyers, support conversions, and strengthen customer relationships. These best practices help fintech companies build effective, measurable campaigns.

SEO Strategy for Fintech: Meeting Buyers Where They Are

Fintech buyers search with clear intent. SEO (search engine optimization) helps your brand get discovered at the right time by the right audience.

- Focus on intent-driven, relevant keywords: Instead of broad financial terms, finance companies should optimize for queries that signal real buyer interest. Tools like Ahrefs and SEMrush identify problem-aware and solution-aware search behavior.

- Adapt for AI Overviews (AIO) in search results: Google’s AI-powered results impact visibility. Understanding which fintech-related queries trigger AI-generated answers helps brands refine content structure.

- Use geo-specific content where relevant: Banking laws, tax regulations, and financial products vary by region. Localizing educational content through region-specific pages, compliance guides, or country-specific FAQs increases relevance.

- Optimize for industry-specific queries: Buyers often look for comparisons, security standards, and compliance details. Addressing searches like “best global payroll solution” or “PCI-compliant payment processing” enhances search visibility.

Continuous Content Optimization

Effective fintech content isn’t static. To maintain performance:

- Refresh and repurpose existing content: High-value content can be updated with new data, examples, and regulatory changes to maintain relevance.

- Analyze search intent regularly: Google’s AI-driven search results impact how fintech brands rank and appear in queries.

- Expand content formats: Transform valuable insights from blogs into video explainers, infographics, and interactive tools.

- A/B test CTAs and landing pages: Small adjustments in messaging and design can significantly improve conversion rates over time.

Measuring Performance and Success Metrics

B2B content marketing without clear performance tracking is a wasted investment. Fintech brands must connect content initiatives to business impact.

Key performance indicators (KPIs) should include:

- Increase brand awareness: Organic traffic from branded search terms can be a good measure of brand awareness

- Organic traffic growth: Search visibility directly impacts inbound leads.

- Engagement metrics: Time on page, scroll depth, and interaction rates indicate content effectiveness.

- Lead generation and conversion rates: High-performing content should increase demo requests, signups, and downloads.

- Pipeline influence: Attribution modeling connects content to closed deals.

Our fintech marketing agency, Stratabeat’s executive dashboard is a powerful tool that provides real-time insights, making it easy for leadership teams to see content marketing ROI at a glance.

3 Examples of B2B Fintech Content Marketing That Works

Top fintech companies use content to educate, engage, and convert their audience. These brands excel by delivering actionable insights, optimizing for search, and addressing buyer concerns.

1. Stripe: Leading with Data-Driven Insights

Stripe, a global payments platform, leverages proprietary research and technical content to position itself as an authoritative subject matter expert, attracting developers, finance teams, and subscription businesses.

What Stripe Does Well:

- Publishes exclusive first-party research unavailable elsewhere.

- Produces in-depth technical content on engineering innovations.

- Runs data-backed experiments to reveal emerging trends.

Key Examples:

- Industry reports on churn, pricing models, and payment performance.

- “How We Built It” series detailing Stripe’s technology innovations.

- BNPL checkout study exploring consumer behavior with alternative payments.

Why It Works: Stripe’s research-backed content positions it as a fintech leader, providing insights finance professionals and developers rely on. Investing in original research and technical deep dives establishes fintech brands as go-to resources.

2. Plaid: SEO-Optimized Content for High-Intent Searchers

Plaid connects fintech apps with banks through a secure API, using SEO-driven content and compliance expertise to attract businesses searching for fintech solutions.

What Plaid Does Well:

- Captures search traffic from buyers actively researching fintech solutions.

- Provides authoritative content on compliance and open banking.

- Showcases real-world customer success stories.

Key Examples:

- SEO-focused guides like “5 Ways Plaid Simplifies Expansion into Europe.”

- Regulatory insights on open banking policies and compliance.

- Customer case studies, such as Plaid’s role in Rocket Companies’ real-time cash flow insights.

Why It Works:

Plaid’s search-optimized, compliance-driven content reassures businesses navigating regulatory complexities. Fintech brands that align content with high-value queries and industry regulations build credibility and organic growth.

3. Wise: Competitive Content That Converts Buyers

Wise converts high-intent buyers with transparent, comparison-driven content that simplifies international money transfers.

What Wise Does Well:

- Creates competitor comparisons to capture purchase-ready searches.

- Educates buyers on hidden banking fees and transparent pricing.

- Develops step-by-step guides on international banking processes.

Key Examples:

- Competitor comparison pages like “Wise vs. TorFX: Which One Is Cheaper?”

- How-to banking guides for global account setup.

- Regulatory content explaining exchange rates and remittance policies.

Why It Works:

Wise addresses buyers at the decision stage with transparent, comparison-focused content that influences switching decisions. Fintech brands that produce competitor-driven content and highlight cost advantages win buyers evaluating alternatives.

| Finance Brand | What They Do Well | Key Examples | Why It Works |

|---|---|---|---|

| Stripe | Leverages data-driven insights and technical content | Industry reports, “How We Built It” series, BNPL studies | Positions itself as a trusted fintech leader through exclusive research. |

| Plaid | Uses SEO-optimized, compliance-driven content | Guides (e.g., “5 Ways Plaid Simplifies Expansion”), case studies | Captures high-intent search traffic and reassures buyers with authoritative insights. |

| Wise | Offers transparent, comparison-driven content | Competitor comparisons, how-to guides on banking processes | Influences decision-making with clear, comparative data and transparent pricing. |

Ready to accelerate your growth

Stratabeat grew a Fintech client’s leads by 4X within the 1st year of their new site launch. See How!Choosing Diverse Content Types for B2B Fintech Marketing

B2B fintech marketing requires diverse content formats to attract, educate, and convert potential customers. Each format serves a specific purpose—some raise awareness, others nurture leads, and some directly support sales. A well-rounded content mix enhances engagement and moves prospects through the sales cycle.

Core Content Formats for Fintech Growth

- Blog Posts: Long-form, search-optimized content that targets solution-focused queries and establishes authority.

- Video Content: Simplifies complex financial concepts through explainer videos, industry insights, and customer success stories.

- Social Media: Expands audience engagement through educational insights, product highlights, and executive thought leadership.

- Influencer Partnerships: Provides credibility through guest posts, co-branded reports, and expert-led discussions.

- Webinars and Online Events: Attracts qualified leads through live demos, panel discussions, and interactive Q&A sessions.

- Interactive Content: Drives engagement through ROI calculators, benchmarking models, and cost-saving simulations.

| Content Format | Purpose | Examples |

|---|---|---|

| Blog Posts | Long-form, search-optimized content to establish authority | Industry trends, regulatory updates |

| Video Content | Simplify complex topics through visual explanations | Explainer videos, customer success stories |

| Social Media | Expand audience engagement and thought leadership | Educational posts, product highlights |

| Influencer Partnerships | Enhance credibility via expert insights | Guest posts, co-branded reports |

| Webinars/Online Events | Engage leads with interactive live sessions | Live demos, panel discussions, Q&A sessions |

| Interactive Content | Provide hands-on tools for evaluation | ROI calculators, benchmarking models, compliance checklists |

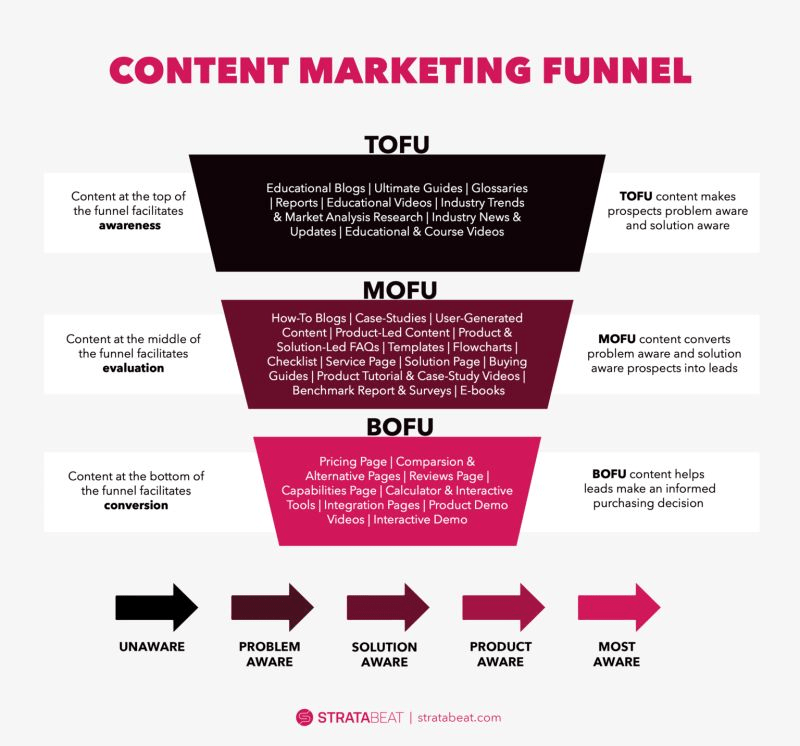

Aligning Content Types to the B2B Customer Journey

A fintech content strategy should guide buyers from awareness to purchase.

Financial companies that align content with the B2B customer journey create a seamless buying experience that reduces friction and increases conversion rates.

Emerging Trends in Fintech Content Marketing

The fintech content landscape continues to evolve. Companies that embrace new formats and adapt to audience preferences will strengthen engagement and expand their reach. Below are three trends shaping fintech marketing strategies.

LinkedIn Thought Leadership Is Outperforming Long-Form Blogs

Fintech executives are often seeing higher interaction rates with concise LinkedIn posts compared to long-form content.

- Executives prefer quick, digestible insights

- LinkedIn’s algorithm prioritizes conversational content

- Text-only posts often surpass blog-driven social shares

Video-First Content Is Driving Higher Engagement

Video has become a more engaging content format, outperforming text-based content in retention and conversions.

- Video simplifies complex financial concepts

- Short-form videos are gaining traction

- Live events and Q&As deepen engagement

User-Generated Content (UGC) Is Building Trust in Fintech

Peer-driven content—such as client testimonials, customer reviews, and case studies—is heavily influencing fintech buying decisions.

- Financial buyers trust real experiences from peers

- UGC builds credibility in a highly regulated industry

- Brands using UGC see higher conversion rates

| Trend | Key Features | Impact |

|---|---|---|

| LinkedIn Thought Leadership | Concise, digestible insights that outperform long-form blogs | Higher engagement rates and better audience interaction |

| Video-First Content | Simplifies complex financial topics; short-form videos popular | Improved retention and conversion through engaging visuals |

| User-Generated Content (UGC) | Leverages customer testimonials, reviews, and case studies | Builds trust and credibility through real peer experiences |

Overcoming Challenges in Fintech Content Marketing

Fintech content teams face unique obstacles, from compliance constraints to long sales cycles, to proving business impact. Addressing these challenges ensures content supports revenue growth.

Understand Compliance Regulations Before Creating Content

Financial content must align with industry standards (GDPR, FINRA, SEC) to avoid legal risks and credibility issues.

Best practices:

- Collaborate early with compliance teams to prevent bottlenecks.

- Use clear, factual language—avoid exaggerated claims.

- Include disclaimers where necessary to maintain transparency.

A compliance-first approach reduces delays, protects brand reputation, and fosters confidence among financial buyers.

Securing Executive Buy-In with Data

Leadership teams prioritize business impact over creative execution. Speak their language to fast-track approvals.

- CEOs prioritize market leadership—position content as a category-defining tool.

- CFOs focus on CAC & LTV—demonstrate how content lowers acquisition costs.

- Sales teams care about pipeline—tie content to lead generation and deal acceleration.

Content aligned with business KPIs moves through approvals faster and secures long-term investment.

Proving Content ROI: Aligning Strategy with Revenue Impact

Executives prioritize content that contributes to revenue. Marketers must connect content efforts to financial performance.

Make Revenue the Benchmark

To prove ROI:

- Track content’s pipeline impact (use attribution models).

- Equip sales with content that converts (objection-handling assets).

- Demonstrate cost efficiency (SEO-driven content reduces paid acquisition reliance).

When content impacts revenue, it’s an investment—not an expense.

Maximize Content Impact with High-Conversion Formats

Some content formats generate stronger engagement and conversions than traditional B2B blogging:

- Case studies: Showcase ROI with real-world success stories.

- Best-of lists: Capture buyer-ready searches from readers evaluating solutions.

- Alternative pages: Steer competitors’ prospects toward your solution.

High-performing content comes from a strong collaboration between marketing, sales, and customer success teams.

Scaling Content Production with External Support

Producing fintech content consistently can strain internal teams. Outsourcing content development speeds up execution and maintains the expectation of high-quality content.

- Content Marketing Agencies: Offer full-scale content strategy, planning, production, editing, optimization, and analytics.

- Freelance Content Writers: Provide flexible, on-demand content support.

External resources provide agility and expertise without increasing overhead.

The Role of AI in B2B Fintech Content Marketing

AI is changing how fintech brands approach content marketing. AI Overviews, ChatGPT, and other tools present opportunities for increased efficiency and search visibility.

AI as a Tool for Process Efficiency

AI streamlines research, content ideation, and performance analysis without replacing human expertise.

Ways AI supports fintech content marketing:

- Speed up SEO research: AI tools surface high-intent keywords and content gaps faster.

- Analyze industry trends: AI detects emerging fintech patterns faster than manual research.

- Generate draft content (with human oversight): AI streamlines blog outlines and reports.

- Personalize content recommendations: AI tailors content based on user behavior.

AI enhances workflows, allowing fintech marketers to focus on strategy and storytelling.

Why AI Overviews Haven’t Killed TOFU SEO

Despite changes to search algorithms, TOFU SEO remains an essential traffic source for fintech brands.

Stratabeat’s analysis of 20 fintech companies found that TOFU keywords still drive the majority of search volume:

- For smaller B2B websites, only 3.5% of non-branded ranking keywords included AI Overviews

- For large fintech companies, only 5.3% of high-volume TOFU keywords were impacted by AIO

- TOFU content still presents a massive opportunity

Ignoring TOFU SEO is a missed opportunity. AI Overviews may evolve, but fintech brands that optimize for foundational searches like…

- “Global payroll solution”

- “Ecommerce payment processing”

- “Accounts receivable automation”

…will be on the winning side of the equation.

Balancing AI-Optimized Content Across the Marketing Funnel

A strong B2B content strategy serves buyers at every stage of their journey:

- TOFU: Educational blogs, reports, and explainers attract problem-aware buyers.

- MOFU: Case studies, webinars, and industry deep dives nurture leads.

- BOFU: Product comparisons, demos, and ROI-driven content accelerate conversion.

AI doesn’t replace content marketing—it enhances execution, insights, and engagement.

| AI Role | How It Supports | Key Benefits |

|---|---|---|

| Process Efficiency | Speeds up SEO research, trend analysis, and draft content generation | Enhances workflow, allowing focus on strategy and creativity. |

| Personalization | Tailors content recommendations based on user behavior | Increases content relevance and engagement. |

| Balancing Across the Funnel | Supports content strategies across TOFU, MOFU, and BOFU stages | Complements human expertise without replacing the creative process. |

Take a Strategic, Results-Driven Approach to Fintech Content Marketing

Successful fintech content marketing is structured around consistency, data-driven execution, and measurable impact. Financial organizations that prioritize audience-focused content, AI-driven fintech SEO, and diverse formats will expand visibility and increase engagement.

High-impact content generates leads, strengthens pipeline, and expands market share. If your content isn’t delivering business results, it’s time for a new approach.

Stratabeat is a B2B fintech SEO agency that helps fintech brands build content that delivers business impact.

We specialize in:

- Precision-engineered SEO to increase visibility and organic traffic

- Content-ICP fit verification to attract and convert high-value prospects

- Advanced audience insights aligned with fintech decision-makers

- Conversion optimization to turn traffic into revenue

Let’s build a fintech content plan that moves the needle. Talk to us today.

Related Blog Posts